How Interest Rates Influence The Stock Market

Interest rates are a crucial factor in the financial system, influencing various economic activities, including the performance of the stock market. When central banks change interest rates, they have a ripple effect throughout the economy, impacting everything from consumer spending to business investment and, ultimately, stock market valuations. We will break down the ways in which interest rates affect the stock market, covering key concepts and their impact on market behaviour.

The Role Of Interest Rates In The Economy

Before delving into how interest rates affect the stock market, it’s important to understand the broader economic context. Interest rates are the cost of borrowing money and the return on investment for savings. They are typically set by a country’s central bank, such as the Federal Reserve in the United States, and can be adjusted to either stimulate or cool down economic activity.

When interest rates are low, borrowing money becomes cheaper, encouraging businesses and consumers to take out loans, invest, and spend. This often leads to higher demand for goods and services, which can boost economic growth. Conversely, when interest rates are high, borrowing becomes more expensive, leading to reduced spending and investment. This can slow down economic growth and, in some cases, lead to a recession.

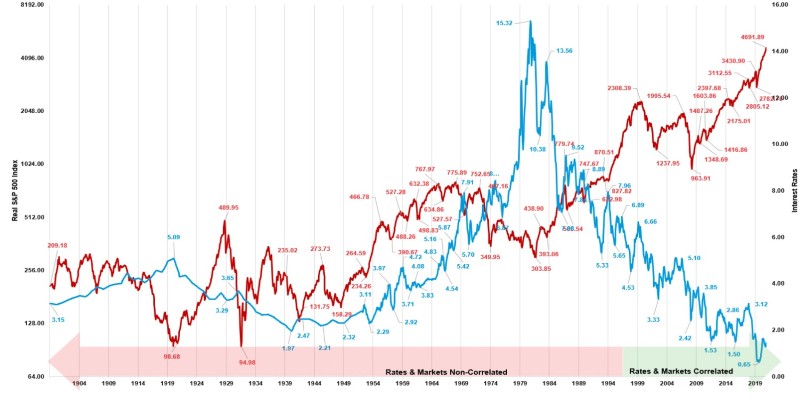

Interest rates also play a direct role in the pricing of financial assets, such as stocks, bonds, and real estate. The relationship between interest rates and asset prices is crucial in understanding how the stock market reacts to changes in the central bank’s policy.

Interest Rates And Stock Market Valuation

One of the most significant ways interest rates influence the stock market is through stock valuation. The value of a stock is often determined by the future earnings it is expected to generate, adjusted for the time value of money. The time value of money is the idea that money available today is worth more than the same amount in the future because of its potential to earn interest or be invested elsewhere.

When interest rates are low, the present value of future earnings becomes more attractive. This is because investors can borrow money at a low cost, making investments in the stock market more appealing compared to other options, such as bonds or savings accounts. As a result, low interest rates tend to drive up stock prices as investors seek higher returns in the equity markets.

On the other hand, when interest rates rise, the present value of future earnings decreases. Higher interest rates increase the cost of borrowing, which can reduce business investment and consumer spending. This can lead to lower corporate profits, which in turn lowers stock prices. Additionally, higher interest rates make bonds and other fixed-income investments more attractive, as they offer higher returns. As a result, investors may shift their money from stocks to bonds, putting downward pressure on stock prices.

Interest Rates And Investor Behavior

Changes in interest rates can also affect investor behaviour, which can have a significant impact on the stock market. When interest rates are low, investors may feel more confident in taking on riskier investments, such as stocks, because they are seeking higher returns than what they can get from savings accounts or bonds. This behaviour can drive up stock prices as more money flows into the equity markets.

Conversely, when interest rates rise, the appeal of riskier investments decreases. As borrowing costs increase and the potential returns from stocks become less attractive compared to bonds, investors may move their money out of the stock market and into fixed-income assets. This shift in investment preferences can lead to a decline in stock prices.

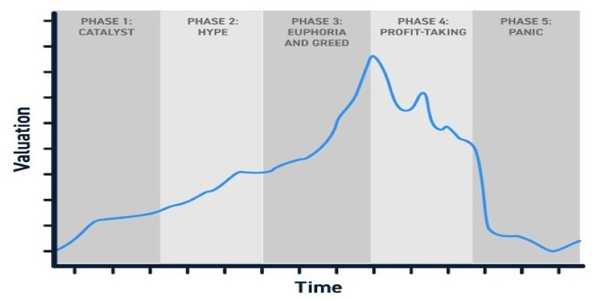

Moreover, changes in interest rates can influence investor sentiment and expectations. For example, when central banks raise interest rates, it may signal concerns about inflation or the economy overheating. This can lead to a decrease in investor confidence, resulting in sell-offs in the stock market. On the other hand, when central banks lower interest rates, it may signal an attempt to stimulate economic activity, which can boost investor confidence and drive up stock prices.

Interest Rates And Sector-Specific Effects

The impact of interest rates on the stock market is not uniform across all sectors. Different industries react to interest rate changes in different ways, depending on their sensitivity to borrowing costs and economic conditions.

For example, the financial sector, particularly banks and lenders, is directly impacted by interest rates. Banks make money by borrowing at short-term rates and lending at long-term rates. When interest rates rise, they can charge higher rates on loans, which increases their profit margins. Conversely, when interest rates fall, banks may see their profits shrink as the difference between borrowing and lending rates narrows.

On the other hand, sectors that rely heavily on borrowing for expansion, such as real estate and utilities, are more sensitive to changes in interest rates. Higher interest rates increase the cost of financing for these companies, which can reduce their ability to invest in new projects or expand operations. As a result, stocks in these sectors may underperform when interest rates rise.

Consumer discretionary stocks, such as those in retail or entertainment, can also be affected by interest rates. When interest rates rise, consumers may cut back on spending due to higher borrowing costs, which can negatively impact sales and profits in these sectors. Conversely, when interest rates fall, consumers may be more willing to spend, which can boost demand for goods and services and lead to higher stock prices in these sectors.

Conclusion

Interest rates are one of the most important factors influencing the stock market. Changes in interest rates affect stock prices by altering the present value of future earnings, influencing investor behaviour, and impacting the broader economy. Low interest rates tend to boost stock prices by making borrowing cheaper and encouraging investment in the equity markets. In contrast, higher interest rates can lead to lower stock prices as borrowing costs rise and investors shift their money into bonds and other fixed-income assets.